SCERS Lowers Long-Term Investment Assumption to 6.75%

The SCERS Board of Retirement adopted new actuarial assumptions that will be used to set contribution rates beginning in July 2021 to keep funding on track and benefits secure for the system’s 25,000 members and retirees.

“This is always a sensitive issue because assumption changes usually mean that contributions for both employers and employees will increase, and while the timing is never good, we are duty-bound under the state constitution and as fiduciaries to review our assumptions to make sure we have a sustainable retirement system,” said SCERS Chief Executive Officer Eric Stern.

The most significant change adopted at the May 20 Board of Retirement meeting was to reduce the long-term inflation outlook, which in turn lowers the assumed investment return from 7.00% to 6.75%. “When we assume that the fund will generate less investment revenue, we need to adjust contribution rates to make up the difference to support benefit payments in the long term,” Stern said.

The Board of Retirement conducts an Actuarial Experience Study every three years to review how the plan performed compared to its demographic and economic assumptions. After the 2017 study, the Board lowered the investment return from 7.50% to 7.00%, reflecting a lower inflation and investment outlook.

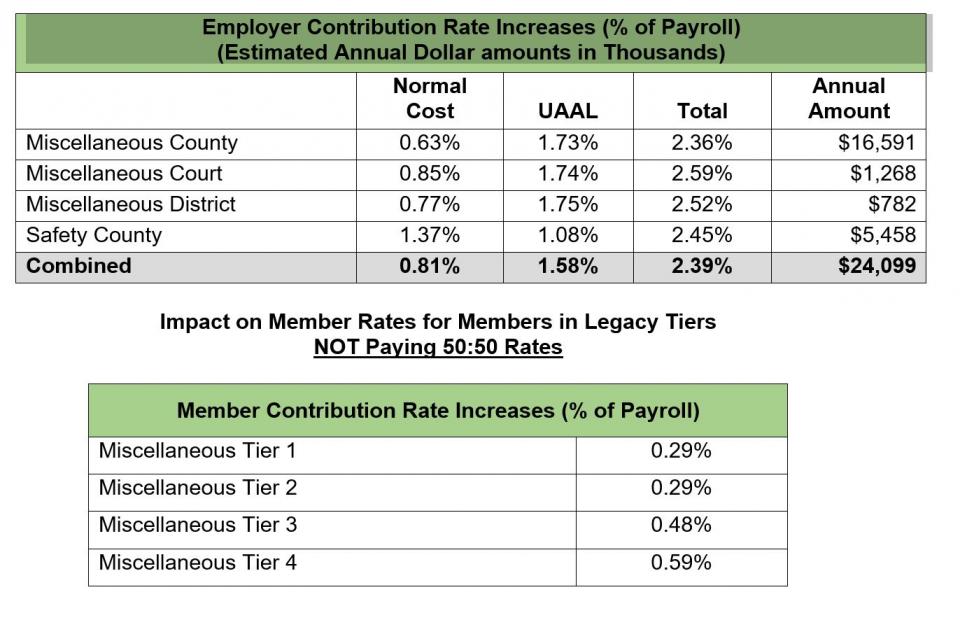

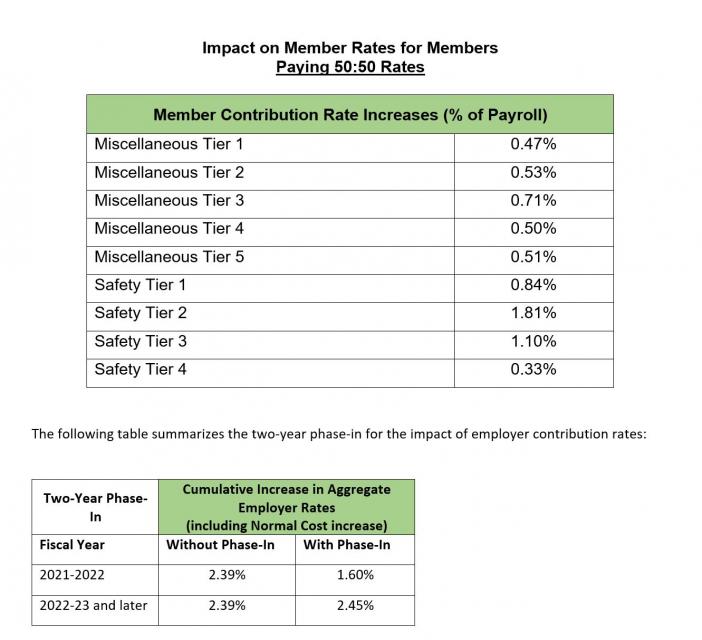

The magnitude of adjustments in the 2020 study is significantly less than in 2017 but will lead to an average contribution rate increase of 2.4% for employers and 0.8% for members, though it varies depending on retirement tier.

To minimize the costs for employers, SCERS will phase in the unfunded liability portion of the rate impact over two years. The normal-cost increases for employers and members are not phased in because those costs represent the required annual payment for pension service earned each year, based on the actuarial assumptions, that needs to be put aside in the SCERS fund to grow interest. The unfunded liability payment—paid only by the employer—closes the gap when the plan experience falls behind the normal-cost assumptions.

COVID-19 Impact

The Experience Study was developed before and conducted independently of the recent market volatility from the global pandemic, and keeps SCERS in strong position heading into economic downturn. After building in the new assumptions and liabilities from the study, SCERS funded status drops to 80% of assets on hand to pay for future benefit obligations.

The investment assumptions are based on long-term projections of an average investment return; a sharp increase or decrease in a single year will not influence that long-term outlook. Any investment losses in 2020 will be recognized, or smoothed in, over 7 years, then amortized over 20 years under the SCERS funding policy to minimize contribution-rate volatility. When the economy rebounds, those investment gains will be amortized and built into future contribution rates, offsetting prior year losses.

Shared Responsibility

Pension funding is a shared responsibility between employers and employees to “pre-pay” for benefits through contributions during an employee’s working years, to allow those contribution to generate investment income over time.

While costs have increased for employers and employees, investment earnings are still the engine that pays for benefits. Over the last 20 years, investment earnings paid for 61% of every dollar of retirement benefits that SCERS provided to retirees. Employers made up 29%, while employee contributions provided 10% of the cost of benefits. In other words, SCERS members only pay a dime for every dollar of pension benefits they receive, earning a 10-to-1 return on their paycheck deductions.

Employer and member contribution rates for the upcoming 2020-21 fiscal year have already been adopted and can be found at https://www.scers.org/actuarial-information.

Contribution Rate Increases beginning July 2021

The following tables provide details on the cost impacts associated with assumption changes.